Whistleblower Rudolf ELMER: the Chronology

You can access this chronological representation directly at www.ansTageslicht.de/Elmer-Chronology. Please, see also the other capters concerning Rudolf ELMER!

from 1990

One year after the fall of the Iron Curtain, which had divided the hemisphere into the western and the eastern parts, financial markets were changing rapidly. While tax havens, such as Switzerland and Liechtenstein in Europe, Panama in Central America, or the Caribbean islands, had previously been stashing primarily the money of Western mafia organizations, arms dealers or drug barons; from now on, new clientele started rapidly growing – from the East.

This phenomenon is one of the official explanations why money laundering is combated by law in Switzerland.

However, a closer look at the current situation shows that in reality nothing has changed so far.

Dr. Jean ZIEGLER, a well-known sociology professor in Geneva, published a new book in 1992: "Switzerland washes whiter. The financial hub of international crime". ZIEGLER, a consultant for the United Nations and for the Swiss Social Democrats in the Bern Parliament for almost three decades, is a long-standing critic of the Swiss system. That is exactly why he is insolvent now: multiple lawsuits, brought against him by banks and various powerful people, are aimed at ruining him financially in order to silence him.

Dr. Erich DIEFENBACHER, a lawyer with a doctorate in law and a banking expert , who had survived the war despite the death sentence by an SS tribunal in Wiesbaden in 1945, and went into business as a lawyer in Switzerland, has been constantly drawing public attention to unnatural capital flows associated with tax evasion and different money laundering practices. He published a book contribution entitled "Dirty inheritance - a state affair?” where he denounces the " Christian Schmid System", in which the former companion of the Italian Duce Benito MUSSOLINI had moved his assets to Liechtenstein and Switzerland. A year later, he wrote another essay: "Offshore - Finanzplätze".

Shortly before that, DIEFENBACHER had received a copy of his file from the Swiss "Special Representative for State Security Files" at the Federal Police (BuPo - corresponds to the German BKA or the US-American FBI):

"Motives of the Swiss banking and lawyer cartel for the elimination of Erich Diefenbacher from Swiss legal and business life include, among other things, the steadfastness in the sense (maybe ‘in the case of?) of Christian Schmid: ..." it says on the first page of the secret memo.

In order to silence DIEFENBACHER, a well-known trick of harassing him with fictitious tax debts was used. This method had been widely employed by the former Eastern European Communist regimes as a tool of oppression of dissidents. As a result, the life of the lawyer from Bern had become so unbearable that he had to emigrate from Switzerland and return to Germany.

More at www.ansTageslicht.de/Diefenbacher.

1994

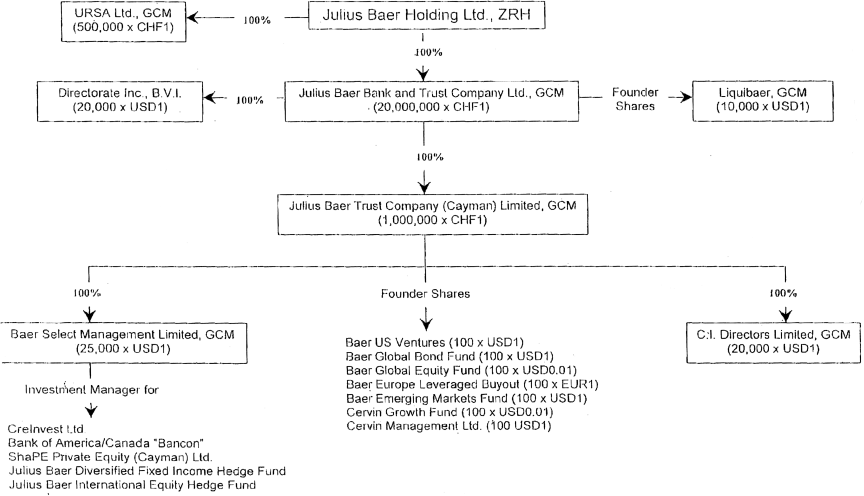

By the time, Rudolf ELMER had already been working in internal auditing for seven years. He started his career as a young auditor at Credit Suisse, then worked for KPMG and after that moved up the career ladder at Julius Baer Bank in Zurich. Bank Julius Baer, Switzerland's largest private bank, is one of the finest in its class and it is also represented on Cayman Islands, a Caribbean archipelago east of Cuba.

Rudolf E. BÄR, Chief Executive Officer of the Baer Group, asked Rudolf ELMER to move to the Cayman Islands branch as Chief Accountant. The branch was planned to be expanded, and its business structures urgently needed to be made more efficient. ELMER was proud of this offer. Much later, in an interview with Süddeutsche Zeitung in 2008, he will remember this moment: "From an auditor checking the books in Zurich to the world where you can lie in the water after hard work and swim in the water."

1995 and after

In his first year at the Cayman Islands office, Elmer worked about 1,300 overtime hours with an average of around 12 working hours a day, since he had a wide range of tasks to cover and meet the deadlines. At first, it turned out to have little to do with "enjoying the sea and observing fish" except Sundays.

Even though the Swiss entity was extremely important for the Baer Group, it was not particularly well organized. In fact, it was not even absolutely necessary until recently, because big money flowed in practically without any marketing effort.

However, as a result of rapid expansion of the business, the complexity of various funds and currency transactions had already significantly increased by that time, which posed additional risks for the clients. Therefore, a certain basic risk-management structure had to be set up and be in place in order to reduce the risk exposure. On joining the company, Rudolf ELMER, as Managing Director Deputy and Hedge Fund Manager, immediately became responsible for many things, such as:

- management of several business areas, such as IT and offices

- security management

- internal controlling, crisis management and emergency strategies

- controlling of the entire financial and account administration

- budgeting and controlling of new financial instruments

- risk management and credit monitoring

- reorganization of the entire process management

- and more.

In a small country, which is really only a holiday place and distinguishes itself above all by crystal-clear sea water, much sun and pleasant warmth, and which cannot be considered particularly well developed in the business world and, above all, the work moral is not particularly impressive.

Trying to improve work motivation, Elmer had to be a role model for staff and act accordingly. From time to time he even had to stay in the office overnight. Especially, when a computer program had not been completed yet but, due to time reasons, the next one had already to be installed or started immediately. At that time, remote control from home had not been developed yet and, even if it had, it would hardly meet the discretionary requirements of the bank’s clients.

It was also Elmer’s responsibility to regularly get on an airplane with the entire data carriers of all accounts and to fly far away, when a destructive Caribbean hurricane was threatening the island’s peaceful life – the so-called business recovery plan.

Thus, ELMER was responsible for almost all aspects of the operational side of the business. His annual salary gradually rose from $110,000 to $212,000 within 9 years.

His hard work and tireless commitment left some serious marks on his health - back and hip pain became a constant companion to Rudolf Elmer over time.

1997

In Switzerland, the law against money laundering was further specified due international pressure: not only regular banks and insurance companies, but also the Para banking sector: independent asset managers, trustees, trusts and similar institutions were included in the new regulation.

However, the law affected only financial institutions either located or legally represented in Switzerland. What was happening on the remote Cayman Island was subject neither to Swiss law nor to Swiss banking secrecy. While being a British overseas territory, the small island with its approximately 50,000 inhabitants has its own legislation, political and business culture.

Thus, the tiny ‘enclave’ has become extremely attractive to businesses and/or individuals who, due to different reasons, are unable to enjoy the Swiss discretion and secrecy and, therefore, preferto bunker their funds and assets in so-called offshore structure like trusts, companies, special purpose vehicles outside the Alpine state but still holding the assets in the name of those structures within Switzerland. Up to 40% of Julius Baer Group’s net profit is now generated on the Cayman Islands - in the premises shown in the photo.

1998

In this year, Rudolf ELMER climbed further up the hierarchical ladder: formerly only Chief Accountant, he also became Chief Operating Officer and Compliance Officer. Responsible for ensuring compliance with legal regulations and international standards - he became the “consciousness” of the company. Whereas ELMER had previously reported directly to top management in Zurich, the Caribbean unit had to report to the New York branch of Julius Baer.

In charge of these new tasks and responsibilities, ELMER had to deal not only with controlling and organization of all money and financial transactions, but also with the purposes and objectives of the transfers. Gradually, he discovered strong indications of tax evasion and money laundering - he found more and more evidence of the use of deceptive accounting tricks in order to mask dubious transactions, which had already gone far beyond the grey area of banking – into the realm of illegality.

Thus, ELMER discovered the accounts of civil engineer Raul SALINAS, brother of Mexican President Carlos SALINAS. Raul Salinas, who had been involved in a murder conspiracy and was later convicted (1999) of complicity turned out to have managed to accumulate several million US dollars during his working life – the money was stashed in a bare trust in Julius Baer.

A little later, ELMER discovered that the Symac Trust transferred 12,000 dollars a month to its owner Mario Arturo ACOSTA CHAPARRO, Mexican brigadier general who, besides being involved in the drug business, was also responsible for the "Flights of Death". The secret police officer was arrested two years later, sentenced to 15 years in prison, released prematurely and murdered in 2012 by competing drug dealers on the open street.

Read more about the Cayman clients of Bank Julius Baer.

On making those discoveries, Rudolf ELMER sounded alarm to his superior, Managing Director of Julius Baer on Cayman Islands. However, the latter did not want to know anything about those illegal activities. The New York CEO was not interested in ELMER’s concerns either.

Contrary to ELMER’s expectations, he was subjected to strong pressure and henceforth cut off from a lot of business information. Finally, ELMER reported to the Zurich headquarters, however, he received no reaction from there and no real support.

A year later

ELMER tried everything to make the Top Management aware of the issues, but he could not convince any of them that it was still possible to make profits on the Cayman Islands in an honest way as well. He had to rethink what he had been doing, especially in the view of the fact that he had been increasingly ignored while reporting a whole series of dubious business transactions. Eventually, he realized that the seemingly weird business practices were nothing more than manipulations and cover-ups.

A striking Example:

The sole shareholder of Julius Baer Bank & Trust Company Ltd (JBB&TC), located on Cayman Islands, is its parent company - Julius Baer Holding AG, Zurich. The JBB&TC is financed with the so-called call money from its clients, mainly from Zurich, but also from other Baer branches around the world. This appears to be a "win-win" situation, since the clients are not subject to the Swiss withholding tax (35%) on call money interest and JBB&TC can finance itself with cheap short-term call money to make long-term investments. The funds acquired this way are used to purchase high-yielding securities and profitable shares. Most of the profits for the Baer Group accrue in the Cayman tax haven.

The banking business is also rather weakly regulated in the Cayman Islands. There are no equity capital requirements, nor any other strong regulations to keep the banks healthy. Therefore, with the sales volume of significantly above 1 billion Swiss francs, a lot was possible for the Julius Baer Group.

However, all sales and purchases related decisions are actually taken in Zurich, where the know-hows of buying and selling financial assets are kept. The same goes for risk management. As a matter of fact, on the Cayman Islands there is only sort of shadow banking, which simply creates the impression (particularly for Swiss Tax Authorities) that everything is decided, managed and controlled there or from there.

For this purpose, fictitious orders have to be subsequently confirmed at JBB&TC via the internal communication system "Lotus Notes". And, in order to be able to present evidence in the worst case scenario, the Cayman management create fictitious protocols showing that all transactions have been authorized and carried out by the Cayman Islands branch of the bank. Once a week, these documents are sent out to the accounting department of the General Secretariat in Zurich as the ‘proof’ that the decision making, risk management and the entire processing functions do take place in the Cayman Office.

Unsure whether he could stay on the Caymans for a long time or if he might flee the island or even be arrested by the US authorities at some stage, ELMER requested an interim certificate to be issued. The bank granted him this.

ELMER’s inner restlessness and his feeling that one expected him to be a silent witness and to accept for granted the facts he had discovered even though they conformed neither to the fundamental international laws nor to the generally-accepted ethical and moral values and principles, continued to negatively affect his health. Since the problem had become a burden not only for him, but also for his family, Elmer started keeping a lower profile and communicated little about it with his wife.

2000 + 2001

Half of the workforce were replaced according to the new local CEO Charles FARRINGTON’s plan, supported by the CEO in New York. The new local CEO brought his own people from the Bank of America and gave them important positions within the organization.

ELMER had to go to a hospital in Miami, where he was given a heart catheter - the stress caused by the high workload and also by the unpleasant feeling that not everything was running properly at Baer Cayman, and that he, as "Compliance Officer," was responsible for it - continued to gnaw at his health.

It was becoming increasingly clear to him that with the introduction of the Qualified Intermediary Agreement in 2000 and of the Patriot Act in 2001, after September 11, the US judiciary and the IRS would tighten the loop around criminal banking, especially in Switzerland. This conclusion was further strengthened by his experience while continuing education seminars in the USA: tax havens located outside the US territory were declared targets.

In 2001, ELMER had a serious road accident – while riding his bicycle, he was suddenly hit by a car, which seemed to have appeared out of the blue, severe headaches and partial lack of concentration were the consequences for the coming months. Elmer assumes and is pretty certain that this was an attempt to get rid of his presence on the island.

Now there was also a financial problem: the health insurance did not cover the examination and treatment costs of 30,000 USD at the Miami hospital. ELMER noticed that Julius Baer had not paid the proportionate health insurance contributions for him for a long time. Complaints to Zurich turned out to be completely useless - ELMER had to cover the costs personally.

2002

Because his employment contract expires this year, negotiations between ELMER and BJB Cayman begin. ELMER is to remain on the Cayman. However, as of September 1, 2002, he will become a local employee. His initial employer is no longer Julius Baer Holding AG in Zurich, but its subsidiary "Julius Baer Bank & Trust Company Ltd" (JBB&TC) on Cayman Island. However, he will continue to report to the management of BJB Zurich, based in New York City (USA):

Meanwhile, in Greece, the media had published various registers of names of investors in hedge funds held by Julius Baer in New York. The compromised accounts and shareholder registers were administered in the Cayman Islands: “TC Multi Hedge Ltd,” “TC Investments Ltd” and “TC INV CL B High Yield Bond.” Due to the published names of the partial shareholder registers, JBB & TC filed a complaint with the police. Later, most of the employees were subjected to house searches. However, the Cayman Police did not discover any wrongdoing. Not even at ELMER’s home.

Surprisingly, only the management were required to undergo a lie detector test - for the purpose of “Clearance of Management,” as it was stated. In addition to the two local JBB&TC managing directors and two employees of the law firm Maples & Calder, Grand Cayman branch, known worldwide for “tax optimization matters,” the BJB Compliance Officer and a member of the Board arrived from New York to supervise the procedure. However, the test did not correspond in any way with the standard rules, commonly accepted in the USA. This was later confirmed in writing in a report by William E. KELLY, C.P.P., a well-known American and proven polygraph test expert.

Rudolf ELMER was the first to be tested. He was especially suspicious for BJB and JBB & TC because he had been too critical and had exposed himself in different, ways. “He is a critical thinker” was the title of the interim report signed by Cayman Management, which ELMER had already received in 1999. Moreover, there were other signs that he had become a “persona non grata” for the Cayman Management.

21 November - Thursday

At 8 o'clock in the morning, immediately on entering the bank’s premises, ELMER was surprised to be ordered at short notice to undergo a polygraph test. He requested time for reflection, since he had slept badly at night and, because of that, had to take sleeping pills, moreover, he had to take painkillers because of his generally bad health.

At 12 o’clock ELMER agreed to discuss the matter with the polygraph expert. However, the conversation had to be stopped already at the preliminary stage - the ongoing pain in the back and at the hip became stronger. ELMER had been undergoing physiotherapeutic treatment since summer and suffered from hip arthrosis. Having taken an increased dose of painkillers, ELMER wanted to call back at 6 pm, however, his doctor advised him not to take the test in his current condition - the drugs were too strong.

6.00 pm: a third attempt due to the pressure from the bank, and again abortion. The new local CEO, Charles FARRINGTON, requested ELMER’s office key and his company identification card. ELMER was requested to sign a statement that he agreed with investigation to which he added the following: “I do not take this test as a condition of employment or continuation of employment and I have been advised that I cannot be forced by anyone to take this test.”

The fact that ELMER was not fit for the test healthwise was extremely important because satisfactory health condition is a prerequisite for all tests of this kind, according to the US standards. That was why he deleted the statement that there were no “physical or mental” problems that prevented him from underdoing such a test and added the above statement.

However, when Elmer received a copy of this form later, the most important sentence that he "would not see this test as a condition for..." had been deleted - without his authorization. According to the labor law it meant that the test could thus be used as a reason for employment contract termination.

22 November, Friday

The next morning at 8 am, ELMER was treated physiotherapeutically in order to make another attempt possible. The lie detector test was scheduled for 10 am. ELMER stopped the test again. The lie detector expert started insulting ELMER. ELMER left Maple & Calders and returned home.

23 November, Saturday

Around 2 pm, CEO Charles FARRINGTON called ELMER at home. As ELMER remembers, he wanted him to “return the stolen documents.” Then he could also help. Otherwise, FARRINGTON threatened ELMER, a lot could happen to his family!

Right after that

ELMER immediately called his lawyer to clarify his rights and to request protection. He needed a confident and official person knowing the procedures – it was needed not only for his own protection but also for the protection of his family. He became nervous at the end and called in sick.

On Friday, November 29, flights had been booked for the entire family - vacation in Switzerland. There was also a medical beam of hope for ELMER in Switzerland - well-known recognized specialists not available on the Islands.

December 2002

However, holidays were out of the question for Rudolf ELMER. His home doctor referred him directly to an orthopedist to clarify a possible herniated disc. Computer tomography (CT) showed 3 herniated discs - ELMER went immediately on a sick leave, he could not work anymore and had to lie. Returning to Cayman Islands in this condition was ultimately impossible. However, ELMER’s lawyer informed his employer on Cayman Islands that after recovery he could return and take another lie detector test, provided that he was in satisfactory health condition. The bank did not respond.

On 10 December, while still lying on his sick bed, ELMER received mail from Cayman Islands: the termination of the employment contract effective on March 10th, 2003. Now, he knew that everything was over. Yet, he tried to involve the CEO of the Baer Group, Walter KNABENHANS, as well as a member of the Board of Directors, but his requests to repeat the test were rejected – employment contract termination without notice due to the lie detector test not carried out is legal on Cayman Islands!

ELMER’s wife travelled to the Caymans shortly before Christmas in order to vacate the apartment and organize the move back to Switzerland.

ELMER’S health continued deteriorating. At the end of the month he was inspected by a neurosurgeon. The inspection showed that he urgently needed surgery at two points of his intervertebral disc. Moreover, the highly sensitive spinal canal (vertebral canal) is to be enlarged. ELMER had to stay on sick leave until the end of March 2003. Now it also became clear to him that a lie detector test could not work.

2003

In February, ELMER was invited to a meeting with the General Counsel of BJB Zurich, Christoph HIESTAND, and the head of the "Human Resources" department, Dr. Georg SCHMID. His dismissal was to be discussed again. ELMER remembers this conversation very well - should he take the bank to court, he would be finished up by Julius Baer, he was told.

Because he had already realized that he had been working for a partially criminal organization, ELMER wrote anonymously to some clients in order to ensure protection for his family. He suggested to the clients that they should stop all illegal business. For this ELMER used a template to be designed individually. About 15 clients contacted by ELMER got in touch with the Zurich Management. The Management did not like it at all. However, the clients realized that ELMER was in possession of databases that could expose their business activities and behavior, and that ELMER considered those databases as sort of life insurance for himself and his family.

With the beginning of spring and after a successful surgery Rudolf ELMER did better again. He could apply for a new job again. He started working for the Noble Group. From 1 July he was their Operation Officer at a subsidiary Noble Investments Ltd. based in Zurich. There he was responsible for the back office and the finance department. Things were getting better again.

September

"~Reudi, stop talking about JBBT business..." was an e-mail from an anonymous Yahoo address in Canada to ELMER's computer

November

Another anonymous threatening email appeared on ELMER’s home computer. ELMER reported it to the “Investigation against unknown” police department in Pfäffikon

2004 - a new year

Another meeting at the Office of Julius Baer Bank in Zurich between ELMER and Christoph HIESTAND, member of the Board of Directors of the Baer Group responsible for legal matters, was unsuccessful. No agreement could be reached. For example, about the still unpaid portion of the bank’s health care costs when Elmer was still an employee at its Cayman branch.

Instead, Bank Julius Baer hired detectives (e.g. from the “Privatdetektei RYFFEL AG, ZUERICH”) to shadow Rudolf ELMER and his family - not quietly and secretly, but quite openly. As an example, those detectives were using a black BMW with Konstanz registration number “KN-RS 34.”

Since all this happened quite openly, ELMER managed to identify a total of 11 men who were after him and his family. For instance, one man followed ELMER to work and back home. Another followed ELMER’s daughter on her way to school and back – as a result, the daughter soon did not dare go to school alone. A third person kept an eye on ELMER’s wife. And almost every day the black BMW or other cars were demonstratively parked first in front of ELMER’s front door, then in front of ELMER’s workplace or on the parking lot opposite the school where ELMER’s daughter went to the kindergarten.

When ELMER spent a holiday with his family in Turkey, two of the stalkers appeared in his office near Noble, presented ELMER’s photo to the secretary and claimed that Rudolf ELMER was wanted by the police. As soon as ELMER was back from the holidays, his boss confronted him because of that.

An unpleasant period began for ELMER –it was obvious that his family was also targeted. How these stalking methods evolved and what effect they had, will be explained in a separate chapter: The "fever curve": pressure and stalking and its effects on Rudolf ELMER.

In November, a third anonymous threatening e-mail arrived, “Stop talking. We will kill you...” This time the message came from a public telephone booth ("Publifon") at Zollikon railway station.

The pressure did not remain without consequences: Rudolf ELMER had to arrange for psychological treatment for his daughter. He himself developed the so-called post-traumatic stress syndrome, as one of his doctors phrased it.

Before the end of the year, BJB tried to come to terms with ELMER again and suggested a mediator: Dr. Georg SCHMIDT, board member of the BJB Foundation, Chief Human Resources Officer and, in this function, member of the extended Executive Committee. ELMER rejected the mediator because of his obvious bias. Now, he himself wanted to make a proposal to the bank.

2005

In February Rudolf ELMER received - again from a public "Publifon", this time in Kilchberg - an anonymous e-mail: “If you talk we will kill your child...” ELMER filed another complaint against the unknown.

One month later, a fifth e-mail of this kind: “We will kill your child first, then your wife and then you if you do not stop...” This time the message came from Wetzikon.

Rudolf ELMER wrote, just in case, “farewell letters”. The letters are always kept on the desk in his apartment, ready to be sent off in case something should happen to him or his family, and in addition to that, they are deposited with third parties. The “hot” data from Julius Baer Cayman is also deposited in several places for security reasons.

In the meantime, Rudolf ELMER burned several data CDs and sent some extracts to Baer clients - data from the tapes that he regularly had to keep at home on Cayman Islands so that a second copy of all bank transactions and client information would exist somewhere, in case of need.

Cayman Islands are very scenic, but the infrastructure is comparatively old-fashioned - electricity and telephone networks are not always stable, everything runs above ground, not underground.

And the building where the Caribbean entity of Baer Holding, Zurich is located, JBB & TC Ltd. (see photo), is not a bank-style building in the classic sense, with multiple secured entrance doors and safe or bullet-proof glass-covered cash registers. Clients in masses are not expected there. On the contrary, almost everyone wants to leave as few traces as possible. The more inconspicuous the perception, the better. And if one or another jetty did go to the Caymans in person, they would be welcomed in noble restaurants. In fact, JBB & TC is more like an averagely equipped open-plan office for 35 employees.

Rudolf ELMER was still in possession of the security tapes he had at home when his office key was taken away from him after the unsuccessful lie detector test. As all his attempts to address the illegal transactions within the Baer Group had been unsuccessful, ELMER felt more and more cornered, and he sent, anonymously, the copied data on CDs to two official institutions

- the Federal Tax Administration

- the cantonal tax office in Zurich

He believed that the tax authorities should be interested in the black and untaxed money of at least those Baer clients who were subject to the Swiss tax law. According to § 47 of the Swiss Banking Act, banking secrecy only applies to money transactions in Switzerland and their clients. However, they do not apply to business and customer relations in the Caribbean area. ELMER made sure that whatever he did would not be punishable in Switzerland. But he wanted to do a little something for tax justice, for the Swiss state and for the Swiss citizens.

Spring 2005

It's ELMER's daughter's birthday. In a thick plastic bag, the father has a bigger surprise than he is on his way home on the train. He is really looking forward to the expectant eyes of the children. And right: There the joy is great - for the daughter. It is only now that Rudolf ELMER notices that he is missing his second thin plastic bag; he must have left it in the train. Content: his own set of those CDs’, which he had sent to the tax authorities. The demand at the Swiss Railway remains unsuccessful: No one there has left a white bag of CDs anywhere. ELMER does not feel well. He cannot change anything anymore.

summer 2005

On June 15, the Wall Street Journal and the Financial Times published some Baer related information: at Julius Baer in the Cayman Islands, sensitive client data had been stolen and it had been leaked to the US tax authorities, the IRS.

The next day, the DRS, a Swiss television channel, reported that the CASH, a magazine published in Switzerland, also had received such a CD.

The weekend that followed was marked by an intensification of the detectives’ surveillance - several cars in front of ELMER’s house kept watching. This time the cars had license plates of the state of Zurich. On Monday, journalist Lukas HÄSSIG reported in the magazine WELTWOCHE on Elmer’s case and called him at home. He left a message on the answering machine: he wanted to talk to ELMER. Lukas Hässig also proudly announced that a copy of his article draft was already available on Julius Baer Bank’s intranet.

ELMER tried to reach the journalist - without success.

Meanwhile, Julius Baer Bank filed a complaint with regards to unauthorized data theft, unauthorized intrusion into their data processing system, violation of trade secrets and violation of banking secrecy.

As soon as the complaint was filed, the WELTWOCHE article by journalist Lukas HÄSSIG is published: “Das Leck im Paradies” (The Leak in Paradise) - on 25 June.

It was stated in the article that the editor was very well informed: “It is about the Swiss national R.E. (the full name is known to the editor), who took the job of the deputy position at the Cayman office in 1997. He submitted a report then to CEO Rudolf Baer.... Baer promised ELMER more staff and a better infrastructure, which never happened. The data theft was the revenge of an employee who felt deceived by the management…”

And:

“The perpetrator even wrote some Baer clients that the US Treasury was in possession of their data. The bank’s victims then threatened to sue the bank for damages. To prevent negative publicity Julius Baer has so far reached a multi-million settlement at least with one client.”

In order to get relief from the pressure of the ongoing surveillance and the negative publicity in the Swiss media, ELMER took a rather not well thought out decision. At least that is how he saw it later. He sent an anonymous email to Bank Baer and Walter KNABENHANS, CEO of Baer Group Management with a recommendation “to stop all actions against any employees of the Baer Group.” Otherwise the client data would go not only to the tax authorities in Switzerland but also to others. Because of that, ELMER was accused of coercion.

Shortly thereafter, KNABENHANS called ELMER on the phone phone: “Could he, ELMER, tell him anything about potential insider trading on the Caymans?” ELMER kept a low profile. Then KNABENHANS assumed a jovial attitude and mentioned casually that the bank had nothing to do with the surveillance. ELMER knew that was a blatant lie - a year earlier the first lawyer of BJB, Christoph HIESTAND, had already explained to him that the bank had spent more than one million SFr on surveillance of him.

September

Since the surveillance would not stop, ELMER turned to the Swiss Victim Support organization. There he was advised to write letters, e.g. to the supervising detective agencies, with a request to forward them to the client. And he should also inform of that the members of the Board of Directors of the Julius Baer Group.

As a matter of fact, ELMER had started writing even before he received this advice - more than 2 years earlier, on March 9, ELMER had already sent a five-page letter to everyone: "Mr. Elmer's concernsrelating to the well-being of JBB&TC." On Septembet 17, he wrote to all members of the Board of Directors of BJB (already a second time). Shortly thereafter ELMER’s doctor issued a sick certificate for a few weeks. Reason: burnout.

The prosecution and the detectives searched the apartment of the ELMER family - looking for data and files. ELMER was interrogated. He confirmed that he had sent CDs marked "ESTV" and "KSTA" anonymously to the Swiss tax authorities. He gets arrested immediately.

Later

The prison doctor, who inspected all new arrivals, confirmed that Rudolf ELMER was absolute unable to work in any way.

According to the Justice authorities, ELMER was to serve in prison until the end of the year. However, on November 1 he turned 50, and criminal justice appeared to be gracious: Elmer was released earlier.

At the same time, his current employer showed less mercy: Noble Investment SA, Zurich, sacked Rudolf ELMER. Reason: loss of confidence due to imprisonment.

ELMER was referred to a psychiatrist by his family doctor – he was traumatized by “black cars,” among other things. Dr. med. Hans Peter BUCHER, a recognized expert, diagnosed a severe “post-traumatic stress disorder.”

2006

At the beginning of the New Year, Rudolf ELMER wrote to the new President and CEO of Baer Holding Group, Mr. Johannes De GIER, who had succeeded Walter KNABENHANS. There are several things that ELMER addressed:

- First of all, he asked to settle the tiresome health insurance matter from his time on Cayman Islands.

- Then, he suggested that the surveillance and the stalking measures should be stopped. If the bank had anything to do with it, Elmer proposed to discuss it directly with the bank before he handed it over to the press.”

- The “dubious tax practices” were also addressed: “Recently, my thoughts repeatedly revolve around the bank’s tax practices, which have made me, as an employee, a henchman of immorality. ... How do you view this issue?”

- Under point 6, ELMER addressed a whole series of concrete suspicious transactions – “transactions, which violate ethics and morals, but which are also very likely not to be in accordance with the law.”

- And finally: “In summary, it is important for me to disclose my side to you in your new function - without going into the details - so that you know both sides and can assess their possible consequences.”

Here is the full text of the internal whistleblower letter.

Meanwhile, it went back and forth behind the scenes of the Swiss judiciary:

- The responsible public prosecutor wanted to close the case due to lack of jurisdiction. Switzerland is not responsible for Cayman Islands. Incidentally, a corresponding procedure is already underway there.

- In addition, the public prosecutor’s office wanted to give the tax administration access to the files confiscated in Rudolf ELMER’s home.

- Julius Baer Bank defended itself against handing over the data to Swiss tax authorities.

- The Tax Appeal Commission II in Zurich decided that the files confiscated during the house search should not be accessible to the Swiss Federal Tax Administration.

- However, Federal Tax Authority could investigate the limited data of Cayman clients provided by Rudolf ELMER, some of whom might be Swiss subjects.

Meanwhile, Rudolf ELMER received an excellent job reference from his last employer Noble Investments, which enabled him to apply for a new job elsewhere again. ELMER quickly found what he needed - the South African Standard Bank of Africa! He moved to Mauritius, a beautiful island in the Indian Ocean off the shores of Africa or almost 900 km off Madagascar. There he became head of the outsourcing center of Standard Bank Offshore in the function of Director.

Prior to this, Julius Baer Bank had tried to reach a quick settlement with ELMER against a payment of 500,000 Swiss francs in monthly instalments over 3 to 4 years as compensation for everything, ELMER should never again be allowed to say or write anything about the bank and its business practices. In addition, he was offered closing of all legal proceedings against him. Rudolf ELMER rejected the “hush money.”

2007

In Mauritius, the ELMER family recovered from the stressful time in Switzerland and were enjoying the new environment. ELMER had regained his strength. Shortly thereafter, he was nominated by his new chief for the “2007 Superstars Nomination,” an award given to particularly deserving employees of Standard Bank of Africa, the second largest bank in the Southern hemisphere. And Switzerland was far away - over 11 hours of flight time.

Nevertheless, the past continued overshadowing him even there. The Swiss Sunday newspaper wrote in the article “German tax offices profit from stolen client data” (quote): “Experts of the case see the alleged perpetrator as a mentally ill person suffering from paranoia. In the letters he accused the bank of trying to murder him. The letters he wrote to bank clients, tax authorities, and the media also are evidence of a confused mind.”

ELMER filed another complaint against the Swiss Baer bank for coercion and stalking. And while the bank finally paid the outstanding health insurance contributions of 28,205.45 SFr, the legal director of the bank in Zurich, Christoph HIESTAND, received a threatening e-mail with unfriendly content, as Rudolf ELMER will learn later, from Mauritius. Sender: robin.hood3055(at)yahoo(dot)com and robin.hoodii(at)hotmail(dot)com.

In October 2007, ELMER wrote again - a third letter of complaint or whistleblower letter to the Board of Directors of Julius Baer. Unfortunately, the original letter no longer exists, only the attachment to the letter, it does not appear in the “Answers” folder either. For that reason, Rudolf ELMER made contact with an ‘institution’ only very few people knew about at this point in time - WikiLeaks.

At the beginning of the year, Julian ASSANGE presented his project to a wider public for the first time: 60,000 activists from various NGOs (non-governmental organizations) at the World Social Forum in Kenya - kind of counterpart to the World Economic Forum in Davos, where the powerful from business and politics meet every year. WikiLeaks had just made public a big self-enrichment plot in Kenya by publishing an internal report of the detective agency KROLL for the new head of government, who wanted to track down the bodies found in the basement of his predecessor, obviously for election campaign purposes. His predecessor, Daniel Arap MOI, had plundered the country for 24 years.

ELMER, who focused his attention on Africa (Standard Bank of Africa), studied these developments very thoroughly - the international Internet platform, which made it possible to unveil previously well-preserved secrets detrimental to many people, sounded interesting. His correspondence with WikiLeaks went well - they showed a lot of interest.

In order to test whether the platform kept what it promised, i.e. to publish everything that was sent to it online and to exercise no censorship whatsoever, ELMER made an experiment - it was important for him to find out beforehand whether the numerous files documenting the international tax evasion of Julius Baer clients would be actually published by WikiLeaks.

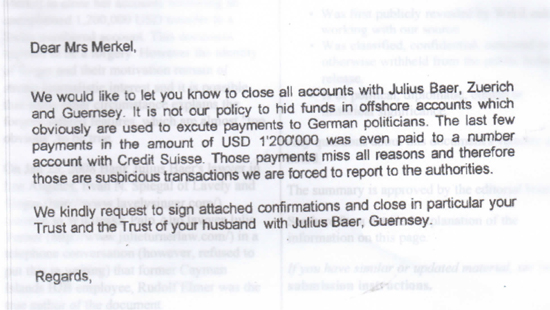

ELMER produced a deliberately fake letter - to “Mrs. Angela Merkel,” sender: “Julius Baer,” content: “They will now close your accounts in Zurich and Guernsey and will have to report all suspicious transactions to the authorities.” Meant to be a test, the letter was made deliberately clumsy – the forgery was easily recognizable, as ELMER hoped:

WikiLeaks did publish this letter online, as promised. Now ELMER would not do that again - since the platform could not prove that what it published was trustworthy, the platform simply put everything what it received online.

2008: 14 February and thereafter

On that Monday, the previously unknown Internet platform WikiLeaks sent a press release to the media: “From today onwards, you can use documents to study the dubious business practices of a Swiss bank called Julius Baer and its office in the Cayman Islands - using many original documents. And the informant would explain his motives in detail in his “whistleblower letter” signed by Rudolf Elmer in order to add credibility!”

At 8:30 pm, Daniel DOMSCHEIT-BERG in Wiesbaden, acting at that time still under the pseudonymous surname “SCHMITT,” who had built up the platform together with Julian ASSANGE and who also looked after Rudolf ELMER, received an e-mail from a Californian lawyer firm, which focused mainly on Hollywood star clientele with a request for WikiLeaks to disclose the name of the author of the documents and delete all material from the web site!

WikiLeaks did not respond. However, the lawyer firm demanded that the WikiLeaks domain www.wikileaks.org be shut down, since it was registered with a Californian address at that time. Judge Jeffrey WHITE at the District Court North California approved the request and its reasoning that it concerned “trade secrets.” WikiLeaks had to go offline - only a white blank page appeared on the web site.

The Court decision resulted in a storm of protests. Big media houses, such as the New York Times or CBS News, published the IP number of WikiLeaks: “Free Speech has a Number: 88.80.13.160.” Numerous NGOs and other groups protested as well. Big media used their own lawyers – it was time to act. They wanted to prevent this incident from turning into a precedent. Their reasoning was obvious: “What if the same principle were applied to the conventional media who wanted to publish such documents?”

Judge WHITE could not ignore the arguments and the references to the first supplementary article of the US Constitution “Free Speech and Free Press,” which guarantees absolute freedom of the press. He lifted the suspension order. On the other hand, Julius Baer also reacted in Zurich – by that time, they appear to have understood what the “Barbra Streisand” effect means: when an attempt to hide, remove, or censor a piece of information has the unintended consequence of publicizing the information more widely.

The "Barbra Streisand effect" is an example of psychological reactance, where people who become aware that some information is being kept secret from them, are incentivized to access and spread it. Barbra Streisand, a well-known singer and actress, enjoyed her life in a generously proportioned estate on the Californian coast, which was shielded from the public. When she tried to sue the photographer, who had taken pictures from a helicopter of her 50 million dollar villa and published the photos, she failed miserably, because her attempts to hide the information inadvertently drew further public attention to it.

Julius Baer Bank found itself in a very similar situation and, as a result, at the beginning of March, it gave in and withdrew its legal complaint.

Thus, WikiLeaks became a world-famous brand overnight due to Rudolf ELMER. And many people learned both about Rudolf ELMER, who lived in Mauritius at the time, and about his criticism with regards to Julius Baer Bank’s offshore business.

ELMER was invited to give lectures at universities and at NGOs, he was interviewed by more and more media. For example, by the Frankfurter Allgemeine Zeitung on 6 March: “These documents contain explosives.” Or on 8 April by SPIEGEL ONLINE: “Explosive confessions of an insider of a Swiss bank.”

However, the Standard Bank of Africa did not seem to be enjoying the new development: “Dear Rudolf, we have learned of a serious misconduct that could endanger our bank!” So, ELMER lost his job at the bank effective immediately. Yet, he quickly succeeded in taking over the Indian beer brand "Kungfisher" for Mauritius as part of an “occupation permit.” His living was thus secured for the next two years.

The year of 2008 will be a milestone in the fight against international tax evasion:

- Rudolf ELMER on WikiLeaks was the starting point.

- Shortly afterwards, Bradley Charles BIRKENFELD, an American bank manager, surrendered himself to the US authorities. As an employee of the major Swiss bank UBS, he had helped wealthy millionaires and billionaires to avoid taxes. The event triggered a crisis in Switzerland. In the end, the bank UBS had to pay a fine of 780 million dollars and hand over the client data of 4,500 clients and American tax evaders - Swiss banking secrecy might come to an end.

- In Germany, the CEO of Deutsche Post, Klaus ZUMWINKEL, was investigated and eventually removed from his position. He had hidden 11.8 million euros from the German tax authorities through his “Devotion Family Foundation” in the Principality of Liechtenstein. In 2003, he was nominated "Manager of the Year" by a business magazine.

- The Principality of Liechtenstein was also getting into trouble: Heinrich KIEBER, an IT specialist at LTG-Bank, owned by the Princely Family, quietly said goodbye to his employer. He had taken with him CDs containing the data of 4,527 Liechtenstein foundations. He easily found a buyer for those tax CDs: the German BND on behalf of the tax authorities (more at www.ansTageslicht.de/SteuerCD).

- Switzerland again: at the end of 2008, computer scientist Herve FALCINI took copies of the data of 130,000 customers and tax evaders from the Geneva branch of the international institute British bank HSBC, then he left for France and submitted the data to the local tax authorities. Several thousand Greek residents turned out to be also listed on it. This lead to the so-called HSBC leak in 2015, which brought the Greek (former) finance minister Giorgios PAPAKONSTANTIOU to the court bank - he had received the Greek list, deleted three names of relatives and then made the list disappear.

2009

In Switzerland, Rudolf ELMER’s 2004 and 2005 police reports of stalking begin to bear fruit. The police interrogated the members of Julius Baer’s Executive Board and the detectives. The bank turned out to have commissioned an external service provider, Daniel von STOCKAR, a former secret service agent, who, in turn, commissioned the private detective agency RYFFEL AG, ZUERICH. They all testified that they only wanted to find out whether ELMER was working again and sending threatening e-mails.

ELMER made a final attempt. He reported Bank Julius Baer to the Office of the Attorney General of Switzerland as a “criminal organization.” He sent the corresponding documents from the Cayman Islands. Within less than 10 days the deputy federal prosecutor Ruedi MONTENARI replied. The Baer Bank received a detailed explanation of the decision of 20 February on 4 pages. Rudolf ELMER received only a short message: The complaint had no consequences and it was turned down.

Since ELMER’s time on Mauritius was coming to an end, and his daughter had already returned to Switzerland because of her schooling, ELMER had to pay attention to his “credibility” in society. In the banking sector his name is “burned” as a whistleblower. Especially in Switzerland.

In Germany, Federal Finance Minister Peer STEINBRÜCK (SPD, Grand Coalition) received a registered letter: ELMER offered him a trade-off - relevant data against protection for his family in Germany. STEINBRÜCK did not answer.

Nick DAVIES of the British newspaper The Guardian wrote two articles about Elmer. The business practices of the so-called offshore companies, such as the Cayman entities of Bank Baer:

“Isle of Plenty”: British banks also play along

"Rare glimpse into offshore world of big money and low taxes": In the center of the hedge fund Carlyle Group and its "investors" - including London based Saudi companies linked to the Bin Laden family construction group.

2010

At the end of 2010, ELMER returned to Switzerland in order to face criminal proceedings. It was his goal to challenge the system in his home country.

In Germany, and also in Switzerland, a new German-Swiss tax treaty was being discussed in politics and in public. It had been recognized internationally that tax havens and tax evasion could not go on as before - everywhere in the public and governments funds were short, however, some privileged groups of people did not participate in the civic duty to pay their taxes to the communities, states and governments.

An article in the business magazine BILANZ entitled “Bank Secrecy: What Betrayal Costs” showed the strange Swiss view of things. In 2010, the Swiss were not ready yet to request that Swiss banking clients acted tax-wise honestly and helped to declare untaxed funds. Switzerland did not request from a client to withdraw funds if they could not prove that their funds had been honestly declared and taxed. This would not change until three years later, when on 4 April 2013, 86 journalists from 46 countries published at the same time the results and evaluations of their "offshore leak" research in a concerted campaign.

2011

Julian ASSANGE and Rudolf ELMER organized a media event at the beginning of the new year to advance the international discussion on tax evasion, and also on ELMER’s court proceedings for bank secrecy betrayal in Switzerland which was due two days later.

In order to give an opportunity to those tax evaders, who could potentially face problems with tax authorities if their names became known, ELMER first wrote them, for the sake of fairness, a letter signed with "Swiss W.”

"Dear Sirs, your banking data and documents with Bank Julius Baer will be made public (Internet Wikileaks) in January 2011 and in addition handed over at the same time to authorities in your home country in order to have them investigated for fraud and other crimes. We recommend to contact Authorities directly before Christmas! We know it is difficult decision in order to help you to make it happen we have pre-informed the local authorities about your case.

Please do not hesitate to contact Julius Baer and the Bank will provide you with further details and how your name, bank account, home etc. will not end on WikiLeaks visible for everyone! They might have a solution as usual.

Swiss W."

WikiLeaks had already become world famous at this point in time. In 2010, one publication of material after another followed: In April a video showing a war crime of American GIs from a helicopter, in which they shoot unarmed civilians, cynically referred to as "collateral murder". Shortly thereafter, the Afghanistan protocols were published. And a little later, the Iraq War Logs. At the end of November - the release of classified cables of US embassies, also known now as the Cablegate. The one, who had anonymously forwarded the information to WikiLeaks, a young US soldier named Bradley MANNING, was be sentenced in 2013 to 35 years imprisonment for it - he had made a mistake and was discovered.

Julian ASSANGE was declared an enemy of the US Government. He lived in London. The famous Frontline Club, an institution of journalists, called a press conference on 17 January 2011: Rudolf ELMER hands over to WikiLeaks 2 tax CDs:

The act of handover was symbolic in nature. Rudolf ELMER, who was subjected to ongoing criminal proceedings in Switzerland for violation of banking secrecy, was aware that he had to be careful. The client data from Cayman Islands had long been with the Swiss tax authorities and the public prosecutor’s office.

It made little sense to hand over the same data again because ELMER had already uploaded some of the data to WikiLeaks. Nevertheless, ELMER demonstratively handed over two empty CDs to Julian ASSANGE. What was important for him in this act - the world media watched it and before the transfer he had been interviewed by many reporters. They also now became aware of how Bank Julius Baer's offshore business on Cayman Island had operated for decades.

19 January 2011

Two days later, on 19 February, Rudolf ELMER was arrested at home for violating Swiss banking secrecy. Reason: the handing over of the two CDs to Julian ASSANGE.

On the same day, District Judge Dr. S AEPPLI, who was in charge of the 2005 criminal proceedings, pronounced his verdict on ELMER’s case after only four hours of trial proceedings: ELMER was found guilty of violating Swiss banking secrecy – even though the public prosecutor’s office was unable to name any single Swiss account that would be affected by the violation of banking secrecy. Furthermore, ELMER was found guilty of threats (against Bank Baer) and the coercion attempted several times (by e-mailing members of Bank Baer's management). The reports and complaints that ELMER had filed were simply ignored by the judge. In concrete terms, it was stated that the public prosecutor’s office was not pursuing Elmer’s complaints any further.

Rudolf ELMER was sent to prison for a total of 187 days in solitary confinement. Since his wife was also accused of having violated Swiss banking secrecy, she was not allowed to visit him during the entire time - because of the danger of collusion.

ELMER’s sentence was immediately announced in the courtroom: a fine of 240 daily rates of 30 SFr each, to be lifted after a probationary period of two years, according to the Criminal Proceedings No. 1 of 2005.

Even though the trial was directed personally against Rudolf ELMER, de facto there was a completely different matter involved in it: it was about the Swiss Banking Secrecy, which needed to be strengthened! Since the entire world media were present, from ARD to BBC, CNN to Television India, it was clear that the Swiss Bank Secrecy was in the international limelight and questioned.

In connection with his new Criminal Proceedings No. 2 (WikiLeaks proceedings 2011 handing over 2 CDs) and his arrest on 19 January, ELMER was not to be released until 25 July.

Of course, the issue was also being widely discussed in Switzerland. He is “not a completely innocent man,” said the renowned Tagesanzeiger, but a “model case of a whistleblower.” The Weltwoche was far more unfriendly: it called him a “dishonorable whistleblower,” a “data thief” and stated that his punishment was far too lax.

2011

In autumn, Bank Julius Baer paid a fine of 50 million euros to German authorities to shorten or terminate the public prosecution investigation in Münster/Germany on suspicion of active involvement in tax evasion by German clients. An anonymous bank employee had offered the state of North Rhine-Westphalia (NRW) a tax CD with the data of 200 German clients of Bank Julius Baer. The state of Nord-Rhein-Westfalen bought the tax CD for 1.4 million. A bargain in view of the 50 million fine income and further millions from the foreseeable tax arrears and fines. Bank Julius Baer got off the hook - in contrast to its German clients.

Almost at the same time, the first appeal hearing took place in criminal proceedings number one against Rudolf ELMER. The Higher Court of the Canton of Zurich did not pass a definitive judgement but made a very unusual decision. The judge returned the case to the public prosecutor’s office. Reason: poor investigation work accepted by the judge of the first court. The entire investigation was to be redone under the supervision and instruction of the Head Judge of the Higher Court of Zurich:

- The threatening e-mails sent from Mauritius to Bank Baer had to be investigated: Who really was the mysterious “robin.hood?”

- It had to be clarified whether the data submitted to the tax authorities were those of the Swiss parent company of Julius Baer or data belonging to Julius Baer Bank & Trust Company on Cayman Islands.

- Whether the data, which clearly originated from the Caymans was subject to Swiss banking secrecy?

- Would the violation of such confidentiality be punishable in Cayman Islands?

- It had also to be clarified whether the data of the CD that ended up with the magazine CASH were the same as what the tax administration received from ELMER.

2012

Julius Baer Bank persistently sabotaged any investigation of the CDs sent by ELMER to the tax authorities. It also tried to prevent the CDs received by the CASH magazine from being used by the Public Prosecutor’s office in connection with the criminal proceedings number one against ELMER. Arguing that the use of the CDs in public hearings might lead to disclosure of private client information, the bank insisted that the CDs should be locked away.

The bank also requested a copy of the CD data from the CASH editorial staff, pointing out that the matter involved the bank itself and the Public Prosecutor’s office. Eventually, the bank took the copy, which had already been trashed by the Public Prosecutor's office, to the Higher Court,. In the court decision of 13 April, the judges allowed the Public Prosecutor’s office to do its “homework,” as requested by the High Court on 17 November the year before.

Those who are interested in the legal haggling over Swiss banking secrecy should take time to read the 21-page court decision (highly recommended).

2013

By that time, Rudolf ELMER had already become an international brand for fighting tax evasion and similar crimes. The Financial Transparency Coalition, an association of Transparency International (TI), Global Financial Integrity, Christian Aid, Global Witness and the Tax Justice Network (TJN), based in Washington (USA), counted Rudolf ELMER among the most important whistleblowers in the fight for transparency in international finance:

It was the time when almost everyone in the entire world was talking about tax evaders, tax havens, profit transfers, etc.:

- Only a year before, there had been hearings in the US Senate, whether such important figures as Microsoft or HP take part in such practices.

- The New York Times published the results of their research, according to which editors such global giants as Apple and Google pay 1% and 3% taxes on their foreign income respectively. The reporters received a Pulitzer Prize for this publication: “How Apple Sidesteps Billions in Taxes.”

- On April 4, 2013, 86 journalists from 46 countries around the world published the results of their two-year research on "Offshore Leaks" - it prompted leading politicians, who had been rather evasive on the issue so far, to make clear statements condemning such behavior and agreeing that it cannot go on any longer.

- The so-called “Cyprus model” collapsed in Europe - the island had been widely known as a banking center and tax haven for oligarchs from Eastern European countries, also those who were facing bankruptcy.

However, the international recognition that Rudolf ELMER was enjoying contrasted his life situation. The whole family entirely depended on his wife's income. In Switzerland he was burdened by two criminal proceedings - one on appeal, the other before opening. Healthwise, he was not doing great either - the threatening external circumstances did not allow him to recover and regain his strength..

The domestic media were also significantly contributing to the situation, since they were extremely reluctant to adjust their content and admit the obvious and well-known facts with regards to the international discussion of tax evasion and banking secrecy, even though it had already become clear that Swiss banking secrecy was getting closer and closer to its end and therefore it was requested to hide its identity more and more using more expensive offshore structures (trusts, companies with bearer shares etc.).

After several banks had been forced to pay considerable fines to the US authorities and one of the smaller banks, Bank Weggelin in St. Gallen, had even gone bankrupt, Switzerland finally agreed to accede to the US FATCA terms and to start participating in the international exchange of data on bank accounts and clients according to the Foreign Account Tax Compliance Act (FACTA).

Nevertheless, ELMER was still considered by many to be an unscrupulous "traitor," who had discredited national economic interests.

2014

This view was apparently shared by the public prosecutor Dr. iur. Peter C. GIGER, who came up with a 33-page indictment against ELMER in June - for “violation of banking secrecy and falsification of documents.” He demanded that ELMER should be sentenced to 4 and a half years in prison and “maximum professional ban as a bank employee.”

Meanwhile, the political environment was evolving further. The Swiss government agreed to automatic exchange of data within the OECD framework. And, in October, the first 41 states signed the agreement at an international conference in Berlin.

At the same time, the major Swiss bank Credit Suisse reached an agreement with the USA. It paid 2.8 billion dollars as part of the settlement. Julius Baer Bank, whose negotiations with the US tax authorities were still under way, was facing a fine of around 500 million (half a billion!) Swiss francs.

On December 10, shortly before the end of the year, in which many tax evaders were outed in Germany, who had evaded taxes with the assistance Swiss banks, from Alice SCHWARZER to Uli HOENEß, the criminal trial against Rudolf ELMER opened in the District Court in Zurich. After two and a half hours, during a break, ELMER collapsed and was immediately taken to hospital again. From there he was transferred to the psychiatric clinic, where he had already stayed for three weeks. The doctors declared him completely incapable of attending the trial or working. The trial was adjourned.

19 January 2015

The court had called in its own expert, who declared ELMER able to attend the trial. Public prosecutor Dr. Peter C. GIGER assumed a hard position against ELMER:

- He was not a whistleblower, but “an ordinary traitor.”

- He himself had been part of the system, which he now denounced.

- "With his publication, ELMER had demonstrated the most aggressive form of betrayal of secrets, which was unconceivable by any rule of law."

- ELMER’s behavior and attitude had been extremely complacent and stubborn.

4 February 2015

Julius Baer Bank reached a settlement with the US Department of Justice: the bank paid 547.25 million, more than half a billion, dollars in fines in order to close the case.

US investigators found out that Julius Baer had managed up to $4.7 billion in approximately 2,600 undeclared accounts of US citizens. Between 2001 and 2011, the bank made a profit of 87 million dollars. The whole thing ran through a system of hidden accounts and code words illegally set up by Julius Baer.

Yet, the Swiss judiciary seemed to be little impressed by this development - the responsible judges continued treating tax evasion as a minor offence, focusing their efforts on sanctioning as painfully as possible the people, who had drawn attention to such criminal activities.

12 February 2015

The District Court (Chairman, Dr. S. AEPPLI, Vice-President of the Court) issued its verdict: Rudolf ELMER was found guilty of multiple violations of banking secrecy and forgery of documents (MERKEL-letter). The fine was suspended for the probationary period of 3 years. The court rejected the professional ban demanded by the public prosecutor.

ELMER appealed the verdict immediately and had to wait again for the next court hearings in 2016.

Meanwhile, international policy on trans-border tax evasion was gradually making further progress.

23 August 2016

Appeal judgment of the Higher Court of Zurich:

Whistleblowing was not referred to in the sentence review process. The only two issues under consideration were:

- To what extent the claim of the Public Prosecutor’s office that ELMER had violated Swiss banking secrecy could be legally justifiable and, therefore, whether ELMER must be punished for doing so.

- To what extent ELMER’s conduct towards his former employer constitutes a criminal act, punishable according to the law.

The judges were reluctant to make their decision.

Indeed, Rudolf ELMER definitely was not an employee of the Swiss Julius Baer Bank & Co. AG, Zurich. He was an employee of an independent subsidiary of Baer Holding AG, Zurich, in Cayman Islands. Thus, ELMER could not have violated Swiss banking secrecy at all, since he was not a Swiss employee.

The Public Prosecutor’s office tried to play down this aspect again and again, although ELMER’s employment contract was unequivocal on this point. The labor law expertise performed by a well-known law professor and federal judge, fully confirmed this fact, which made the total collapse of the entire criminal case absolutely unavoidable. Thus, the disclosure of 2008 documents and 2 CDs to WikiLeaks in 2011 could not, therefore, be an offence subjected to the Swiss law.

On the other hand, the judges considered ELMER’s conduct after his dismissal not corresponding to the law and sentenced him to 14 months in conditional prison with a probation period of 3 years for threats, attempted coercion and forgery of documents against his ex-employer. Since ELMER had been in custody for 220 days, he did not have to return to prison.

Thus, the court proceedings totally ignored the whistleblowing aspect. The frustrated Chairman of the court and Chamber President Peter MARTI addressed ELMER with the following harsh words: “You are not a whistleblower, but an ordinary criminal. A real whistleblower stands by what he has done and invokes justifications.”

He continued as follows: “Using his position, ELMER has for years co-organized offshore business at the forefront and earned well from it. He made the confidential data public not because of his internal rejection of the illegal practice, but out of anger at his former employer - because he had not been promoted. It was a revenge campaign against the bank.”

Judge MARTI did not comment on ELMER’s further whistleblower activities. It was clear that before sounding an alarm and exposing wrongdoings to the public, one must first understand the system in which he is integrated. However, “system” employees are usually functionally integrated only in their respective sub-areas and have no access to information about other aspects. This is how bank secret services function. As ELMER was gradually promoted, he eventually gained insight into what had really happened at the Cayman branch of Julius Baer Bank.

Thus, even though the Swiss judiciary represented by the Zurich High Court appeared to be entirely against whistleblowing at the financial center of Zurich, ELMER could only be punished on secondary issues. The frustrated judge MARTI came up with a special punishment: ELMER had to bear most of the court and investigation costs. Around 350,000 francs, as MARTI had calculated. This was apparently supposed to be a clear signal to all other potential whistleblowers in Switzerland.

At the same time, the judge - probably unintentionally - gave a signal in a completely different direction: tax fugitives bunkering their money in branches of Swiss banks in tax havens could no longer assume that they would be protected by Swiss banking secrecy.

ELMER will appeal again - to the Swiss Federal Supreme Court.

10 October 2018 - two years after the judgement by the Higher Court of Zurich

Judgment: Swiss banking secrecy does not apply to Cayman Islands!

The fact that the Swiss banking secrecy business model no longer works and has practically disappeared is described in a special chronology under the title “Swiss Cheese: How a well branded product became more and more perforated.”

The Swiss Supreme Court ruled and dismissed the appeal of the Higher Public Prosecutor’s office of the state of Zurich against ELMER’s acquittal in this matter. ELMER also submitted to the highest Court in Switzerland his own complaint.

After a public hearing, the judges reached a groundbreaking decision, albeit with a narrow majority: 3:2. The majority of the judges assumed that ELMER was not employed by a Swiss bank located in Switzerland. He was an employee of an organization located on Cayman Islands – as was clearly stated in his employment contract. Therefore, he was unable to break Swiss banking secrecy.

The other two judges (SVP) argued that the Swiss bank Julius Baer had delegated its tasks to its overseas subsidiary “JBBT,” however; the majority did not accept this assumption: since Julius Baer had outsourced part of its business to Cayman Islands this business is subject to the local law. This is also the rule for multinational corporations. Thus, ELMER had only been able to violate the local law od Cayman Islands.

The Supreme Court thus confirmed the acquittal of the previous court decision in August 2016 in this case. ELMER’s appeal of the conviction based on threats and attempted coercion of his former employer was dismissed by the federal judges.

However, the Supreme Court dismissed ELMER’s appeal against the decision that he had to pay 3/4 of all the costs (allegedly) incurred during the investigation and the proceedings. Rudolf ELMER has to pay approx. 350,000 Swiss francs according to this state of affairs.

The reasons for the judgment have not been made public yet.

The NGO Tax Justice Network referred to the decision made by the Swiss Federal Supreme Court as follows: “Whistleblower Rudolf ELMER's court victory: the long arm of Swiss secrecy law gets shorter!”

February 2019

The Swiss Federal Supreme Court eventually presented a 46-page document explaining the reasons for the ruling announced in October 2018.

Prof. Dr. Werner KALLENBERGER has written a discussion on the subject: “On litigation, banking secrecy, trusts and whistleblowing” (in German).

August 2019

After Rudolf ELMER has been acquitted of the accusation of violation of banking secrecy by the supreme Swiss court, he is still to pay the court costs amounting to approx. 350,000 Swiss francs. This is not possible for him.

Rudolf ELMER now goes one step further and lodges a complaint with the European Court of Human Rights in Strasbourg: with a corresponding complaint for violation of Article 6, paragraph 2 concerning the presumption of innocence.

At the same time there is a crowdfunding initiative to cover the costs (see video on YouTube).

You can access this chronological representation directly at www.ansTageslicht.de/Elmer-Chronology.

(investigation: ACG + JL; writer: JL)

Online am: 23.10.2019

Aktualisiert am: 27.10.2019

Inhalt:

Whistleblower Rudolf ELMER: against tax evasion and Bankhaus Julius Baer

- Rudolf ELMER: an overview

- Whistleblower Rudolf ELMER - the Chronology

- Rudolf ELMER -the long story short

- Prof. KALLENBERGER on litigation, banking secrecy, trusts and whistleblowing

Tags: